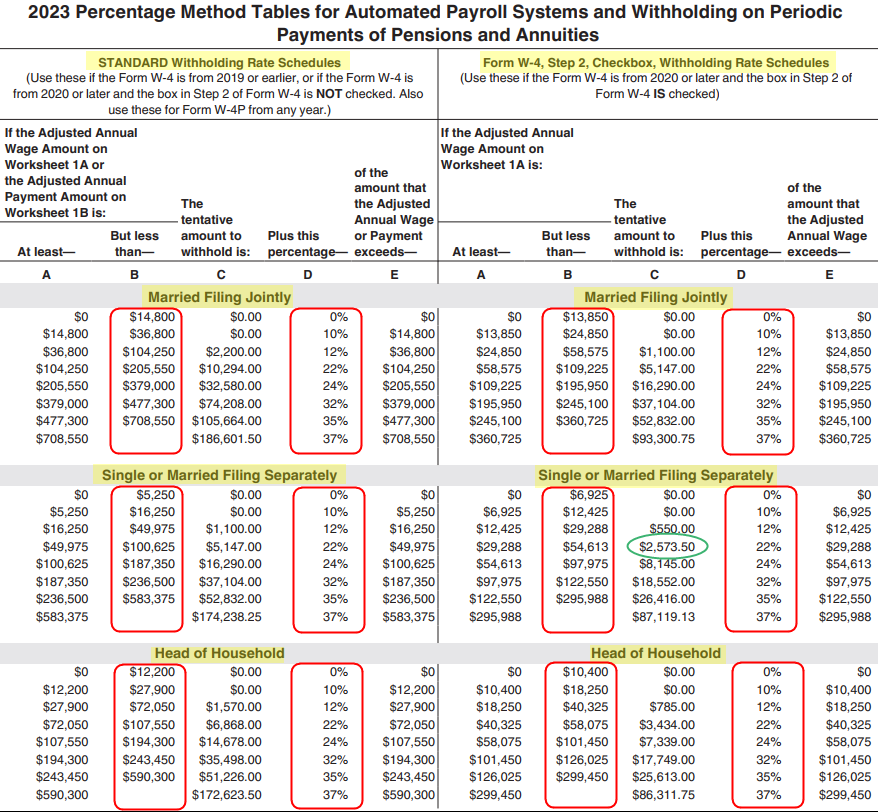

chart of accounts withholding tax. Withholding tax rates vary depending on the type of payment being made but can be as high as 30%. Withholding tax is calculated and posted to the appropriate withholding tax accounts at different stages, depending on the legal.

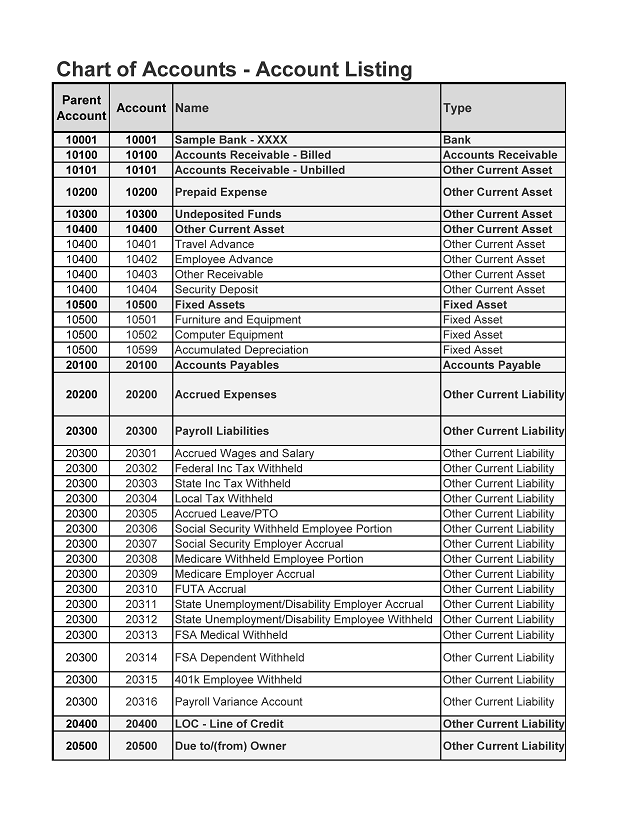

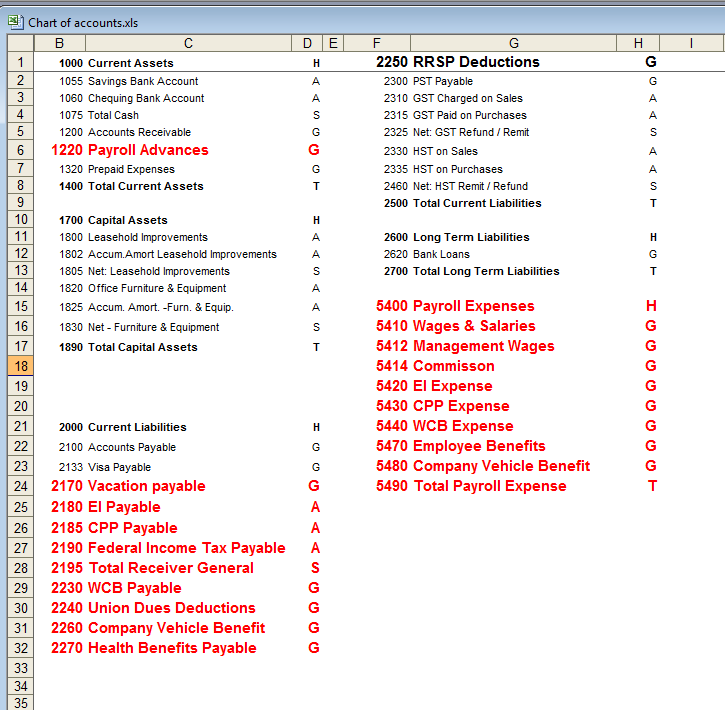

chart of accounts withholding tax Enter the bill you've received from the contractor: Create a withholding tax current liability account in your chart of accounts. Define general ledger accounts for the withholding tax transactions.

Withholding Tax Rates Vary Depending On The Type Of Payment Being Made But Can Be As High As 30%.

Enter the bill you've received from the contractor: The company or individual making the. Create a withholding tax current liability account in your chart of accounts.

Use Withholding Tax On Sales Invoices To Reduce.

These accounts are required for each withholding tax posting. Failure to withhold and remit the correct. Withholding tax is calculated and posted to the appropriate withholding tax accounts at different stages, depending on the legal.

Define General Ledger Accounts For The Withholding Tax Transactions.

As a seller or supplier who issues sales invoices indicating the need to withhold tax, you must do four things: